Security and Safety

For a safer, healthier, and cleaner world

The digitalization of society and critical infrastructure creates an increasing need for security and safety against unauthorized access. The continuous growth of the security solutions market opens up interesting perspectives for investors.

Why invest in security and safety?

As opportunities and growth become connected and integrated, so do risks. An incident that at one time would have engendered costs at a local level now reverberates on a global scale.

New vulnerabilities arise in cyberspace, and critical infrastructure needs to be kept safe – all of which increases the demand for security and drives innovation.

Contemporary methods of protecting assets and mitigating consequences are essential, and the diverse range of companies that are able to supply such security services are poised for growth and profits.

Fast-evolving market

The security and safety space is evolving fast. Providers with an acute awareness of the international scope and technological dimensions of security today are redefining the industry and growing their market share. With the security and safety sector offering significant structural growth potential that is not reflected in current valuations, the perspectives for investors are impressive. At the same time, the market is still relatively exclusive, since the complexity and rapid developments require an intimate knowledge of the field.

Market growth is bolstered by key long-term drivers such as technology innovations, the ongoing digitalization of society, growing concerns about our own health and environment, more stringent regulation, and an increased emphasis on personal security in the wake of population growth and migration.

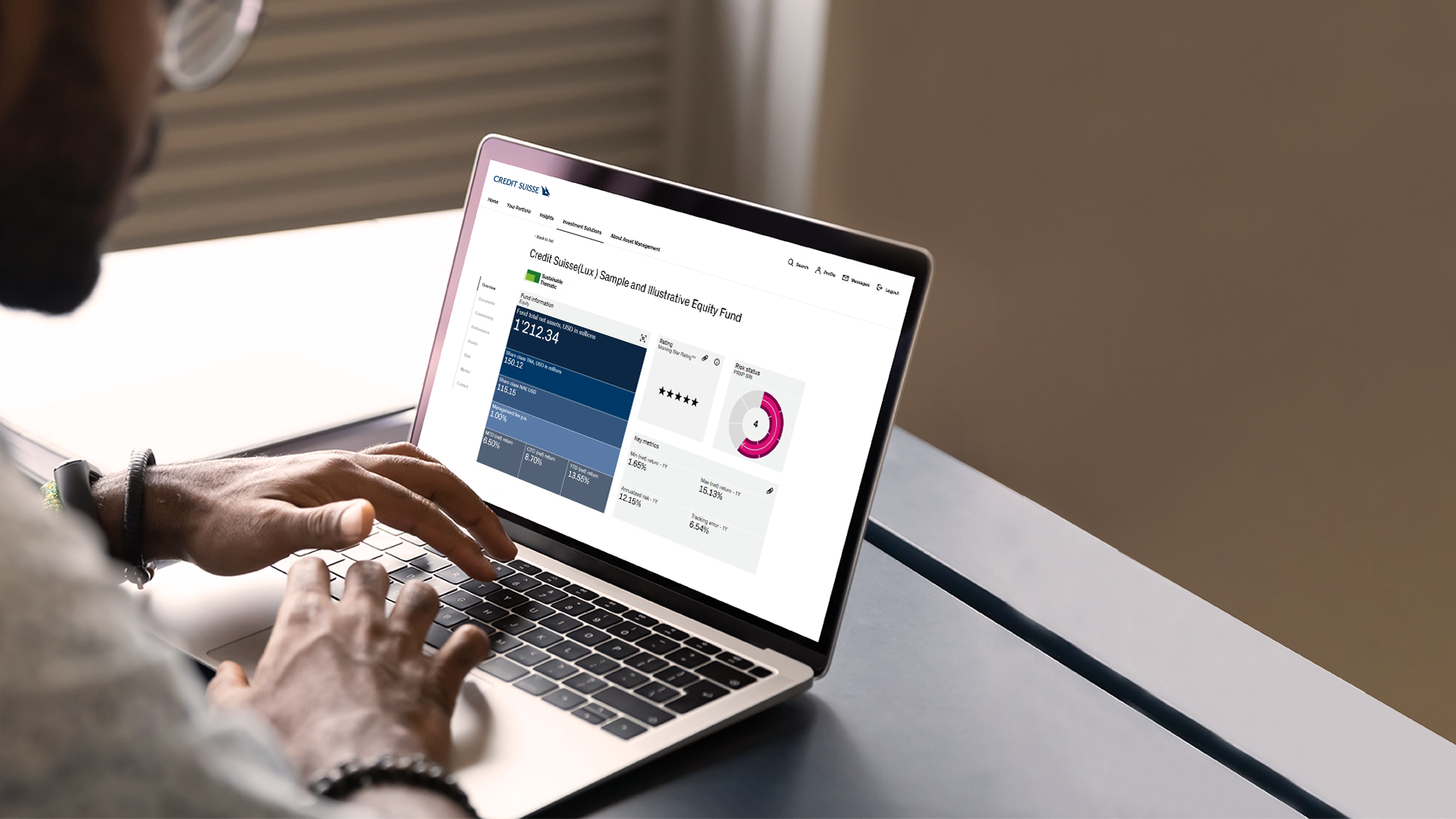

Our security and safety investment solution

The Credit Suisse (Lux) Security Equity Fund focuses on pure-play companies that provide security or safety solutions1. The fund provides an opportunity to invest in innovative companies at the forefront of an attractive secular growth trend along the subthemes of IT security, crime prevention, transportation safety, health protection, and environmental security. The portfolio typically consists of 40 to 60 stocks, many of which are small- to mid-cap in size.

The fund applies exclusions and integrates ESG2 considerations into the investment process in line with the principles of the Credit Suisse Asset Management’s Sustainable Investing Policy.

Risks

- Equity markets can be volatile, especially in the short term. Investor may lose all or part of the invested capital.

- A focus on security and safety companies can lead to significant sector/regional exposures.

- A slowdown of the world economy may impact the security and safety sector.

- Liquidity risk (exposure to small caps).

- Equity markets can be volatile, especially in the short term.

- Due to the possibility of an increased exposure to emerging markets, the fund may be affected by political and economic risks in these countries.

- In cases of significant inflows- or outflows, there may be a disparity in the value date among stocks from different countries, which can result in short-term currency exposure.

Investment possibilities

Find investment products that suit your personal needs. Choose from our extensive range of investment solutions across all major asset classes, and access all product-related information.

Get in touch with Asset Management

Contact us to learn about exciting investment opportunities. We are here to help you achieve your investment goals.

The full offering documentation including complete information on risks may be obtained free of charge from a Credit Suisse client advisor, representative, or, where applicable, via Fundsearch (credit-suisse.com/fundsearch).

1 We define a pure player as a company in which at least 50% of revenue comes from automation solutions.

2 ESG stands for environmental (E), social (S), and governance (G). For further information about the ESG investment criteria and the sustainability-related aspects of the fund, please consider the legal and regulatory documents of the fund (e.g. the prospectus) and visit credit-suisse.com/esg. In addition to sustainability-related aspects, the decision to invest in the fund should take into account all objectives and characteristics of the fund as described in its prospectus or in the information which is to be disclosed to investors in accordance with applicable regulations.

This is a marketing communication. Please refer to the prospectus/information document of the fund and to the KIID/KID (as applicable) before making any final investment decisions. The investment promoted in this marketing material concerns the acquisition of units or shares in a fund and not of any underlying assets. The underlying assets are owned by the fund only.

Source: Credit Suisse, unless otherwise specified.

Unless noted otherwise, all illustrations in this document were produced by Credit Suisse AG and/or its affiliates with the greatest of care and to the best of its knowledge and belief.

This material constitutes marketing material of Credit Suisse AG and/or its affiliates (hereafter "CS"). This material does not constitute or form part of an offer or invitation to issue or sell, or of a solicitation of an offer to subscribe or buy, any securities or other financial instruments, or enter into any other financial transaction, nor does it constitute an inducement or incitement to participate in any product, offering or investment. This marketing material is not a contractually binding document or an information document required by any legislative provision. Nothing in this material constitutes investment research or investment advice and may not be relied upon. It is not tailored to your individual circumstances, or otherwise constitutes a personal recommendation, and is not sufficient to take an investment decision. The information and views expressed herein are those of CS at the time of writing and are subject to change at any time without notice. They are derived from sources believed to be reliable. CS provides no guarantee with regard to the content and completeness of the information and where legally possible does not accept any liability for losses that might arise from making use of the information. If nothing is indicated to the contrary, all figures are unaudited. The information provided herein is for the exclusive use of the recipient. The information provided in this material may change after the date of this material without notice and CS has no obligation to update the information. This material may contain information that is licensed and/or protected under intellectual property rights of the licensors and property right holders. Nothing in this material shall be construed to impose any liability on the licensors or property right holders. Unauthorised copying of the information of the licensors or property right holders is strictly prohibited. The full offering documentation including, the prospectus or offering memorandum, the Key Investor Information Document (KIID), the Key Information Document (KID), the fund rules, as well as the annual and bi-annual reports ("Full offering documentation"), as the case may be, may be obtained free of charge in one of the languages listed below from the legal entity/entities indicated below and where available via Fundsearch (credit-suisse.com/fundsearch). Information on your local distributors, representatives, information agent, paying agent, if any, and your local contacts in respect of the investment product(s) can be found below. The only legally binding terms of any investment product described in this material, including risk considerations, objectives, charges and expenses are set forth in the prospectus, offering memorandum, subscription documents, fund contract and/or any other fund governing documents. For a full description of the features of the products mentioned in this material as well as a full description of the opportunities, risks, and costs associated with the respective products, please refer to the relevant underlying securities prospectuses, sales prospectuses, or other additional product documents, which we will be pleased to provide to you at any time upon request. The investment promoted in this marketing material concerns the acquisition of units or shares in a fund and not of any underlying assets. The underlying assets are owned by the fund only. This material may not be forwarded or distributed to any other person and may not be reproduced. Any forwarding, distribution or reproduction is unauthorized and may result in a violation of the U.S. Securities Act of 1933, as amended (the “Securities Act”). The securities referred to herein have not been, and will not be, registered under the Securities Act, or the securities laws of any states of the United States and, subject to certain exceptions, the securities may not be offered, pledged, sold or otherwise transferred within the United States or to, or for the benefit or account of, U.S. persons. In addition, there may be conflicts of interest with regards to the investment. In connection with the provision of services, Credit Suisse AG and/or its affiliates may pay third parties or receive from third parties, as part of their fee or otherwise, a one-time or recurring fee (e.g., issuing commissions, placement commissions or trailer fees). Prospective investors should independently and carefully assess (with their tax, legal and financial advisers) the specific risks described in available materials, and applicable legal, regulatory, credit, tax and accounting consequences prior to making any investment decision. The alternative investment fund manager or the (UCITS) management company, as applicable, may decide to terminate local arrangements for the marketing of the shares/units of a fund, including terminating registrations or notifications with the local supervisory authority. A summary of investor rights for investing into European Economic Area domiciled investment funds managed or sponsored by Credit Suisse Asset Management can be obtained in English via www.credit-suisse.com/am/regulatory-information, local laws relating to investor rights may apply.

Copyright © 2023 CREDIT SUISSE. All rights reserved.

Representative: Credit Suisse Funds AG1, Uetlibergstrasse 231, CH-8070 Zurich I Distributor: Credit Suisse Asset Management (Switzerland) Ltd., Kalandergasse 4, CH-8045 Zurich I Language versions available: German, English, French, and/or Italian I Supervisor (Entity of Registration): Swiss Financial Market Supervisory Authority (FINMA)

1 Legal entity, from which the full offering documentation, the key investor information document (KIID), the Key Information Document (KID), the fund rules, as well as the annual and bi-annual reports, if any, may be obtained free of charge.