Seeking to generate returns. Sustainably.

Expertise and innovation for a changing world

In a world of finite resources and complex societies, we need to adapt our investment decisions and seek to generate returns sustainably.

Our offering encompasses a broad selection of active and passive investment funds that comply with the Credit Suisse Sustainable Investment Framework or replicate a sustainable index. In doing so, we pursue differing approaches, in which ESG* criteria are applied at various points in the investment process.

Our approach to investing sustainably

Approach

We analyze investment opportunities, taking into account ESG risks of potential investee companies. We are looking for solutions that, for example, reduce global greenhouse gas emissions, increase energy efficiency, or improve recyclability of products.

Commitment

Our specialized team of industry experts identifies green investment opportunities across all asset classes. We understand the environmental impact of products and services, analyze their significance, and detect key impact measures.

Tools

We have access to the tools and data that enable us to identify the sustainability grade within an investment. We quantify the environmental impact of companies, analyze product alignment with relevant Sustainable Development Goals, and investigate potential ESG controversies.

Why the time to act is now?

Climate change is one of the most pressing issues of our time, impacting society and the environment in varied, complex, and often interdependent ways. The steep rise in greenhouse gas emissions in recent decades has triggered a gradual but steady temperature rise, with further increases expected if we do not take action.

The Earth’s rising temperature has led to an acceleration of adverse weather conditions, increased flood risk, more frequent heat waves, loss of precious biodiversity, and challenges to global food security. Each of these effects will have serious consequences for the global economy and could severely impact the living conditions of people all over the world, with the potential to displace millions and create further inequality within communities.

We can make a difference

Grow

We can invest in businesses around the world that provide solutions to facilitate and accelerate the transition to a net zero economy and society. We believe such businesses may provide substantial growth opportunities and often have more resilient business models. As a result, they aim to generate returns, creating a favorable dynamic for both society and our clients.

Engage

By engaging with investee companies and using its voting power at their Annual general meeting, Credit Suisse Asset Management can encourage those companies to commit to net zero and therefore help to accelerate the transition.

Reduce

Our priority is to invest in solutions for the energy transition and to engage with our investee companies to help them set credible transition plans. However, we also pursue a strategy to reduce our exposure to companies that are unwilling to transition, that fail to respond to our engagement efforts, and that have substantial exposure to climate-sensitive sectors.

Investment possibilities

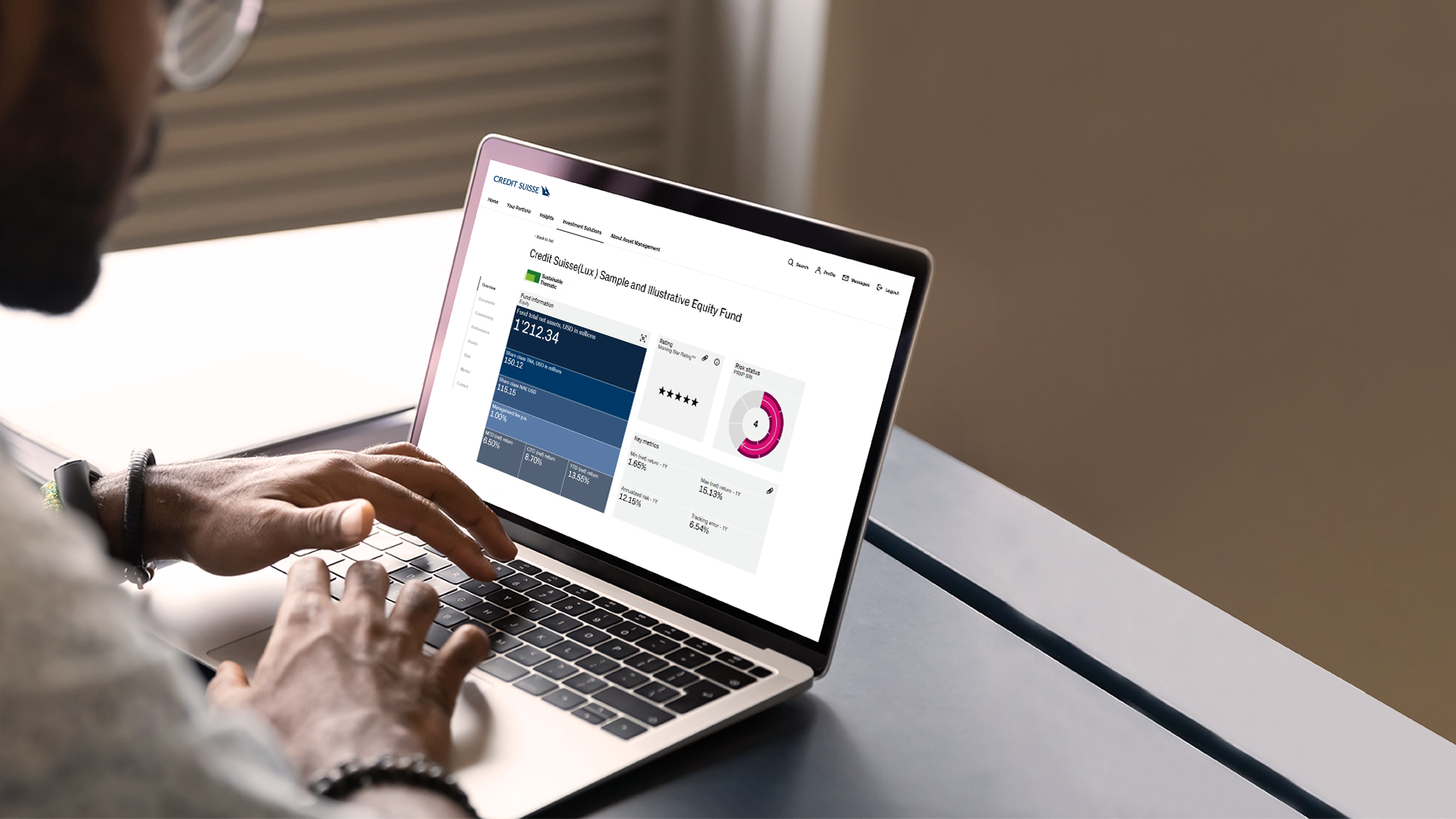

Find investment products that suit your personal needs. Choose from our extensive range of investment solutions across all major asset classes, and access all product-related information.

Memberships

The Net Zero Asset Managers initiative

Net zero is a core sustainability ambition for Credit Suisse. The commitment sets out a range of actions to accelerate the transition to net zero and emissions reductions.

The Institutional Investors Group on Climate Change

We have signed up to the Institutional Investors Group on Climate Change (IIGCC). This underlines our commitment to net zero as a key sustainability ambition.

Climate Action 100+

We are a member of the Climate Action 100+ plan, an industry-wide investor initiative committed to reducing greenhouse gas emissions and fighting climate change.

International Corporate Governance Network

The International Corporate Governance Network (ICGN) aims to promote effective standards of corporate governance and investor stewardship to advance efficient markets and sustainable economies worldwide.

Get in touch with Asset Management

Contact us to learn about exciting investment opportunities. We are here to help you achieve your investment goals.

Opportunities and risks

Arguments in favor of sustainable investing

- ESG investments can curb risk and exert positive impacts at the same time.

- ESG investments tend to exhibit better risk/return attributes than equivalent traditional investments.

- ESG provides space to consider both financial and non-financial objectives, and to balance these according to client preferences and needs.

Potential risks

- Actual asset value performance depends on the chosen investment strategy and the market environment.

- Sustainability investment strategies present a risk of higher tracking errors if they are managed against traditional (non-ESG-compliant) benchmarks.

Your relationship manager will be happy to explain the risks of individual investments to you in detail.

* ESG stands for environmental (E), social (S), and governance (G).

This document is solely for the attention of professional clients, within the meaning of the MiFID, that invest on own account (including management companies (funds of funds) and professional clients that invest on behalf of their client pursuant to a discretionary management mandate). It is not intended for distribution to the public.

For Information Purposes Only, this presentation should not be used as a basis for investment decision

Please refer to the prospectus/information document of the fund and to the KIID/KID (as applicable) before making any final investment decisions.

This is a marketing communication.

The full offering documentation including complete information on risks may be obtained free of charge from a Credit Suisse client advisor, representative, or, where applicable, via Fundsearch (credit-suisse.com/fundsearch).

The individual company referenced above is for illustrative purposes only and should not be construed as an offer to buy or sell any securities

Source: Credit Suisse, unless otherwise specified.

Unless noted otherwise, all illustrations in this document were produced by Credit Suisse AG and/or its affiliates with the greatest of care and to the best of its knowledge and belief.

This material constitutes marketing material of Credit Suisse AG and/or its affiliates (hereafter "CS"). This material does not constitute or form part of an offer or invitation to issue or sell, or of a solicitation of an offer to subscribe or buy, any securities or other financial instruments, or enter into any other financial transaction, nor does it constitute an inducement or incitement to participate in any product, offering or investment. This marketing material is not a contractually binding document or an information document required by any legislative provision. Nothing in this material constitutes investment research or investment advice and may not be relied upon. It is not tailored to your individual circumstances, or otherwise constitutes a personal recommendation, and is not sufficient to take an investment decision. The information and views expressed herein are those of CS at the time of writing and are subject to change at any time without notice. They are derived from sources believed to be reliable. CS provides no guarantee with regard to the content and completeness of the information and where legally possible does not accept any liability for losses that might arise from making use of the information. If nothing is indicated to the contrary, all figures are unaudited. The information provided herein is for the exclusive use of the recipient. The information provided in this material may change after the date of this material without notice and CS has no obligation to update the information. This material may contain information that is licensed and/or protected under intellectual property rights of the licensors and property right holders. Nothing in this material shall be construed to impose any liability on the licensors or property right holders. Unauthorised copying of the information of the licensors or property right holders is strictly prohibited. This material may not be forwarded or distributed to any other person and may not be reproduced. Any forwarding, distribution or reproduction is unauthorized and may result in a violation of the U.S. Securities Act of 1933, as amended (the “Securities Act”).

In addition, there may be conflicts of interest with regards to the investment. In connection with the provision of services, Credit Suisse AG and/or its affiliates may pay third parties or receive from third parties, as part of their fee or otherwise, a one-time or recurring fee (e.g., issuing commissions, placement commissions or trailer fees). Prospective investors should independently and carefully assess (with their tax, legal and financial advisers) the specific risks described in available materials, and applicable legal, regulatory, credit, tax and accounting consequences prior to making any investment decision.

Important information for investors in Netherlands

This marketing material is distributed to professional clients by Credit Suisse Fund Management S.A.

Copyright © 2023 CREDIT SUISSE. All rights reserved.

Distributor: Credit Suisse Fund Management S.A.1, 5 Rue Jean Monnet, L-2180 Luxembourg I Language version available: Dutch I Supervisor (Entity of Registration): Commission de Surveillance du Secteur Financier (CSSF), 110 Route d’Arlon, L-1150 Luxembourg, Tel.: +352 2625 11, Fax: +352 2625 1, Website: https://www.cssf.lu/

1 Legal entity, from which the full offering documentation, the key investor information document (KIID), the Key Information Document (KID), the fund rules, as well as the annual and bi-annual reports, if any, may be obtained free of charge.