First, we need to look at the index tracking industry, a precursor to ETFs. The industry grew quickly as investors were reluctant to accept the high fees charged by active managers. Even if active managers outperformed, the fees they charged could significantly erode returns over time due to the effects of compounding. Index trackers allowed them to gain quick exposure to the market at a fraction of the fees charged by active managers.

The next innovation to come on the scene was the ETF. Unlike index funds, which are open-ended traditional mutual funds, ETFs are securities listed on a stock exchange. There are many benefits to this approach. While an index fund is traded just once a day, ETFs can be traded throughout the day, allowing price limits, stop losses, and other trading techniques.

ETFs offer so much more than just low fees. There is an incredible amount of innovation emerging from this industry. It is evolving rapidly. For instance, ETFs proved their resilience during the dramatic COVID-19 market crash in 2020, when liquidity in corporate investment grade bonds and high yield bonds dried up quickly. ETFs proved their worth, demonstrating that they could be a reliable instrument when other instruments became illiquid. They even served to support price discovery in the bond market, helping to match buyers and sellers at a price that was acceptable to both.

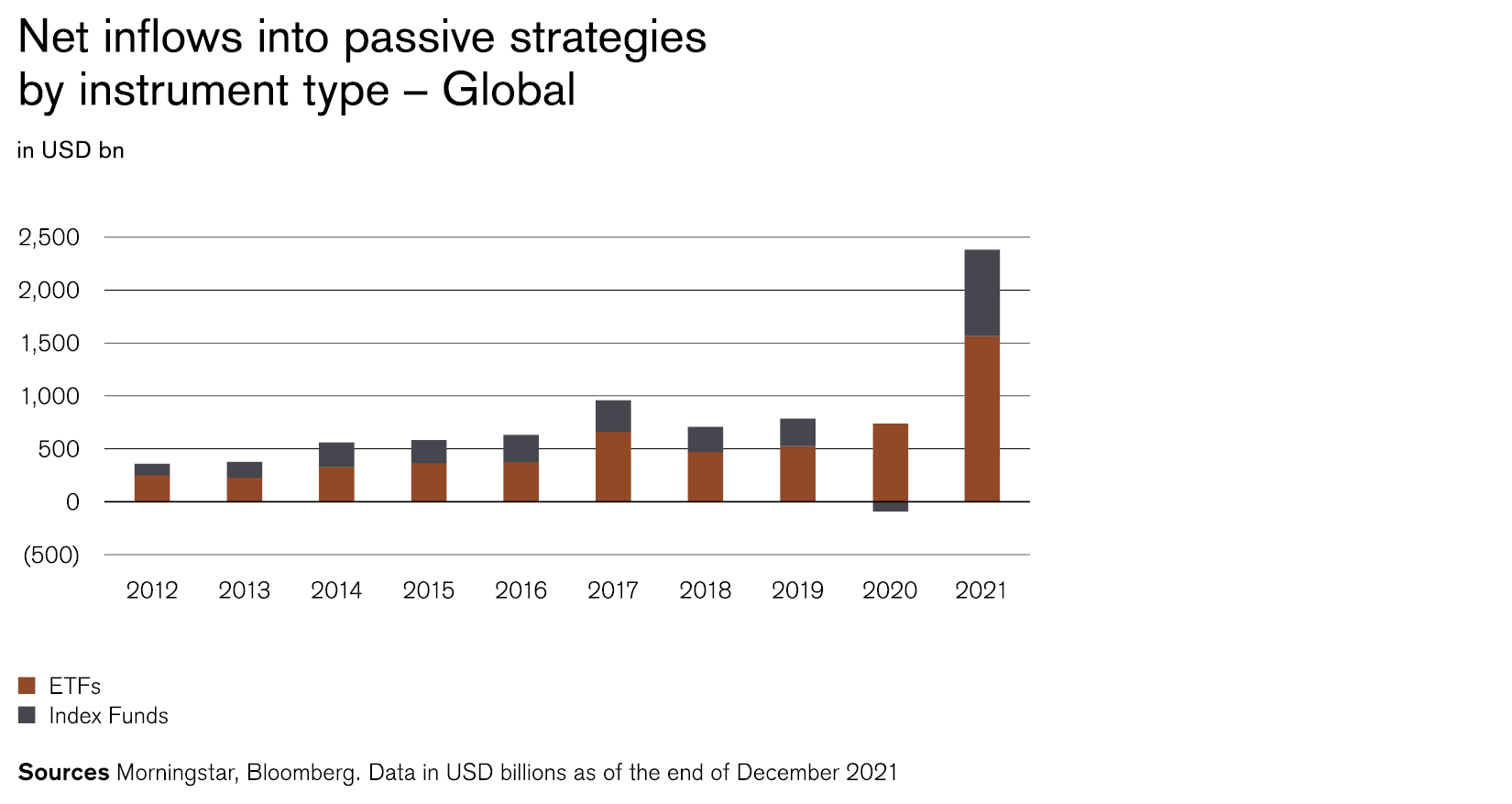

The ETF industry has emerged from the pandemic stronger than ever. Both listed (ETFs) and unlisted index funds saw record net inflows in 2021.

ETFs have proved to be a robust financial instrument

Many different types of investors use ETFs for a variety of purposes. The reasons are no longer limited to seeking passive exposure to an index or reducing fees. Many of those who buy ETFs are actually active investors and come from a variety of backgrounds.

There are investors who want to trade an index frequently. There are also those who want to buy and hold. Then there are institutional investors, such as portfolio managers who want to tactically tilt their asset allocation or build up exposure quickly and cheaply in a certain area of the market. ETFs can also be used by multi-asset teams as building blocks for asset allocation or risk allocation strategies.

The amount of innovation in the ETF industry in recent years has been breathtaking. Some ETFs have been designed specifically to target certain risk factors. Various different construction techniques have also been applied to help move away from some of the drawbacks of traditional cap-weighted indices.

ETFs support sustainable investing

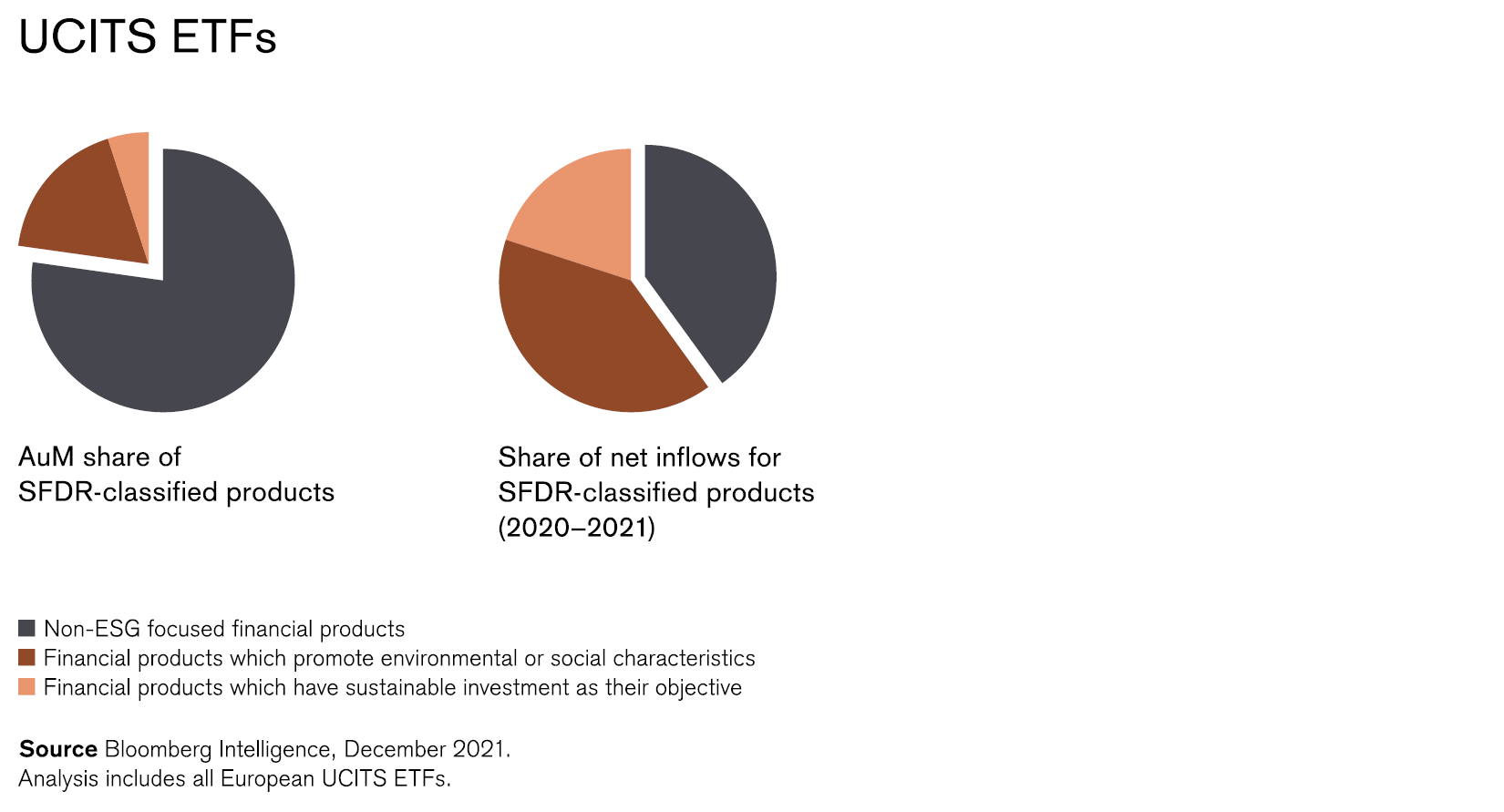

The industry is now well established. Europe’s UCITS ETF market* has already swelled to an eye-watering USD 1.5 trillion. And this figure is expected to grow, given the incredible amount of innovation that has seen the industry continuously expand and evolve.

One of the most interesting trends to emerge has been the use of ETFs in sustainable investing. ETFs can be used to efficiently follow robust ESG scores. Quantitative portfolio construction is also easy to implement with ETFs. Consequently, we have seen a dramatic rise in ESG-themed and ESG-integration products over the last few years.

The chart below shows just how important Europe’s ETF industry has become for sustainable investing. Just under a quarter of all assets under management invested in ETFs are in strategies that support sustainable investing (as of the end of 2021).

However, 60% of new inflows into ETFs have been received by ETFs tied to sustainable investing, which shows just how fast sustainable investing is growing in the ETF industry.