Commodities

Enhancing risk-adjusted returns

Commodities can help manage unexpected inflation risk and generate returns that tend to be uncorrelated with either stocks or bonds.

Commodities offer a pattern of correlation and return that can be distinct from other asset classes, in particular stocks or bonds. As such, they have the potential to diversify and enhance the risk-adjusted returns of a traditional portfolio.

Exposure to commodities can also help portfolios manage inflation risk. One of the most compelling advantages that commodities offer is their differentiated return characteristics during periods of unexpected inflation risk.

Commodities have historically helped to diversify business cycle risk as the asset class tends to behave differently compared to equities during the various phases, such as during late-stage expansion or early-stage contraction.

Our risk-managed approach seeks to maintain the diversification properties of the benchmark, while managing collateral conservatively. We do not add significant duration or credit risk from the cash portion. Our expertise, stability, and experience allow us to provide consistent, transparent, and efficient access to the commodities marketplace.

Investment strategies

Enhanced Index

The Total Commodity Return Strategy seeks to outperform the return of a commodities index, such as the Bloomberg Commodity Index Total Return or the S&P GSCI Total Return Index, using both a quantitative and qualitative commodity research process. Commodity index total returns are achieved through:

- Spot return: price return on specified commodity futures contracts

- Roll yield: impact due to migration of futures positions from near to far contracts

- Collateral yield: return earned on collateral for the futures

Dynamic Alpha Strategy

The Credit Suisse Dynamic Alpha Commodity Strategy aims to achieve a high absolute return by investing in commodity markets.

- Low correlation with commodities, equities, and fixed-income beta

- Relative value approach to exploit pricing anomalies through fundamental and quantitative analysis

- Multi-sector approach that includes energy, agriculture, livestock, and metals

- Exposure through listed and OTC futures, swaps, and options

Investment possibilities

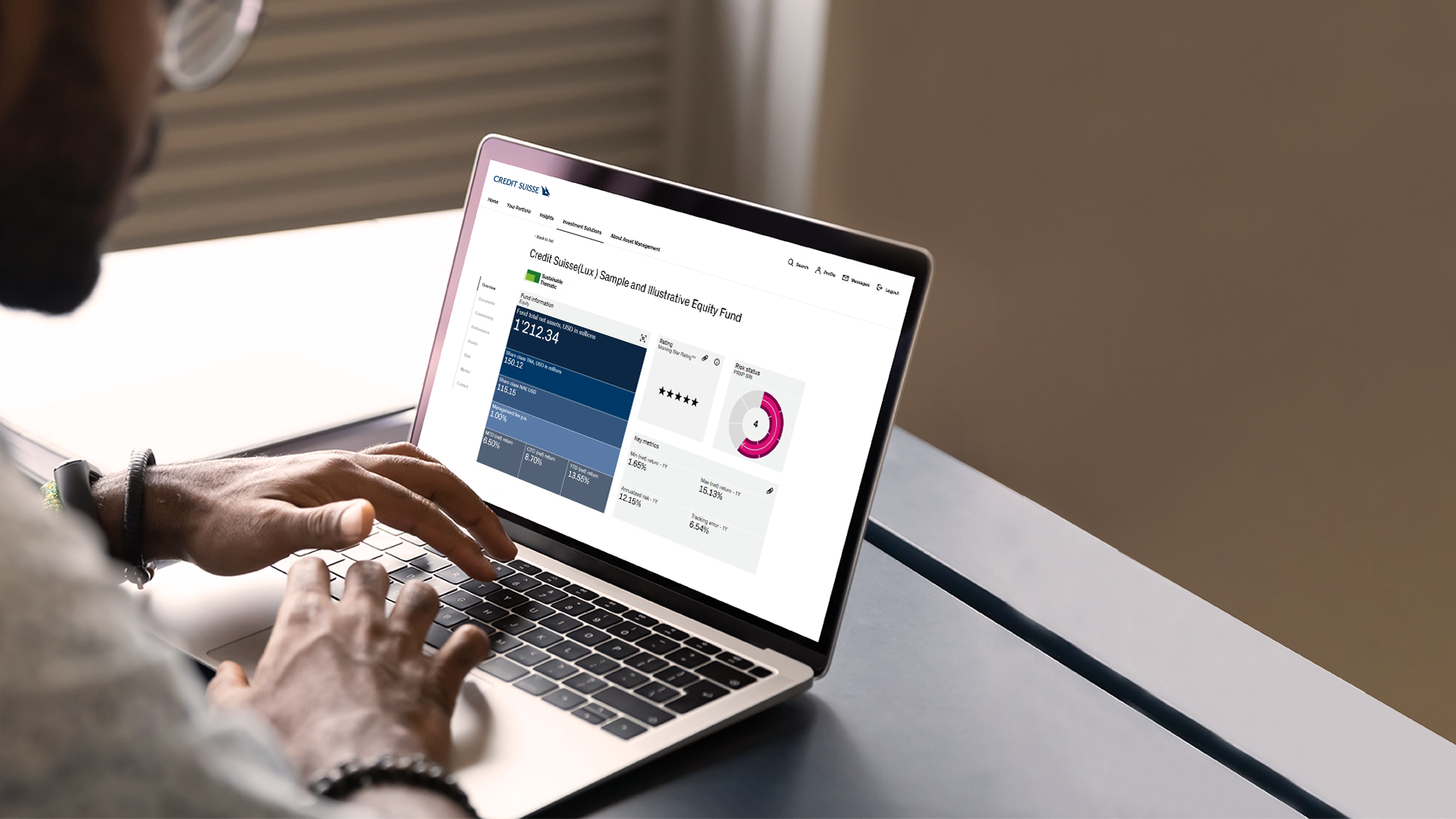

Find investment products that suit your personal needs. Choose from our extensive range of investment solutions across all major asset classes, and access all product-related information.

Get in touch with Asset Management

Contact us to learn about exciting investment opportunities. We are here to help you achieve your investment goals.

Opportunities and risks

Reasons to invest

- Commodities markets and returns are often uncorrelated with other asset classes and provide diversification benefits.

- Commodity investments can act as an inflation hedge.

- Credit Suisse provides access to deep expertise and sophisticated solutions in this space.

Potential risks

- Speculative nature of commodities investments. Investing in commodities is speculative and involves a high degree of risk. There is no assurance that technical and risk management techniques, as well as the investment decisions made by the investment manager, will not expose investors to risk of significant losses.

- Market-driven risk could negatively affect the value of a particular investment.

- Credit risk may occur if a counterparty defaults or is unable to honor a financial obligation.

- Commodity-linked derivatives may be subject to greater volatility than traditional securities.

This is a marketing communication.

Please refer to the prospectus/information document of the fund and to the KIID/KID (as applicable) before making any final investment decisions.

Source: Credit Suisse, unless otherwise specified.

Unless noted otherwise, all illustrations in this document were produced by Credit Suisse AG and/or its affiliates with the greatest of care and to the best of its knowledge and belief.

This material constitutes marketing material of Credit Suisse AG and/or its affiliates (hereafter CS ). This material does not constitute or form part of an offer or invitation to issue or sell, or of a solicitation of an offer to subscribe or buy, any securities or other financial instruments, or enter into any other financial transaction, nor does it constitute an inducement or incitement to participate in any product, offering or investment. This marketing material is not a contractually binding document or an information document required by any legislative provision. Nothing in this material constitutes investment research or investment advice and may not be relied upon. It is not tailored to your individual circumstances, or otherwise constitutes a personal recommendation, and is not sufficient to take an investment decision. The information and views expressed herein are those of CS at the time of writing and are subject to change at any time without notice. They are derived from sources believed to be reliable. CS provides no guarantee with regard to the content and completeness of the information and where legally possible does not accept any liability for losses that might arise from making use of the information. If nothing is indicated to the contrary, all figures are unaudited. The information provided herein is for the exclusive use of the recipient. The information provided in this material may change after the date of this material without notice and CS has no obligation to update the information. This material may contain information that is licensed and/or protected under intellectual property rights of the licensors and property right holders. Nothing in this material shall be construed to impose any liability on the licensors or property right holders. Unauthorised copying of the information of the licensors or property right holders is strictly prohibited. The full offering documentation including, the prospectus or offering memorandum, the Key Investor Information Document (KIID), the Key Information Document (KID), the fund rules, as well as the annual and bi-annual reports (''Full offering documentation''), as the case may be, may be obtained free of charge in one of the languages listed below from the legal entity/entities indicated below and where available via Fundsearch (credit-suisse.com/fundsearch). Information on your local distributors, representatives, information agent, paying agent, if any, and your local contacts in respect of the investment product(s) can be found below. The only legally binding terms of any investment product described in this material, including risk considerations, objectives, charges and expenses are set forth in the prospectus, offering memorandum, subscription documents, fund contract and/or any other fund governing documents. For a full description of the features of the products mentioned in this material as well as a full description of the opportunities, risks, and costs associated with the respective products, please refer to the relevant underlying securities prospectuses, sales prospectuses, or other additional product documents, which we will be pleased to provide to you at any time upon request. The investment promoted in this marketing material concerns the acquisition of units or shares in a fund and not of any underlying assets. The underlying assets are owned by the fund only. Some of the product(s) included in this material may not be registered and/or available for purchase in your country of domicile. If in doubt whether the product(s) is/are registered for distribution in your country, please consult your relationship manager or locally registered distributor. If investment products have not been registered with, or authorized by a supervisory authority, certain investor protections provided under supervisory laws and regulations may not be provided. This material may not be forwarded or distributed to any other person and may not be reproduced. Any forwarding, distribution or reproduction is unauthorized and may result in a violation of the U.S. Securities Act of 1933, as amended (the ''Securities Act''). The securities referred to herein have not been, and will not be, registered under the Securities Act, or the securities laws of any states of the United States and, subject to certain exceptions, the securities may not be offered, pledged, sold or otherwise transferred within the United States or to, or for the benefit or account of, U.S. persons. In addition, there may be conflicts of interest with regards to the investment. In connection with the provision of services, Credit Suisse AG and/or its affiliates may pay third parties or receive from third parties, as part of their fee or otherwise, a one-time or recurring fee (e.g., issuing commissions, placement commissions or trailer fees). Prospective investors should independently and carefully assess (with their tax, legal and financial advisers) the specific risks described in available materials, and applicable legal, regulatory, credit, tax and accounting consequences prior to making any investment decision.

The alternative investment fund manager or the (UCITS) management company, as applicable, may decide to terminate local arrangements for the marketing of the shares/units of a fund, including terminating registrations or notifications with the local supervisory authority. A summary of investor rights for investing into European Economic Area domiciled investment funds managed or sponsored by Credit Suisse Asset Management can be obtained in English via www.credit-suisse.com/am/regulatory-information, local laws relating to investor rights may apply.

© UBS 2024. All rights reserved.

Distributor AM: UBS Asset Management (Singapore) SGR, 9 Penang Road; Singapur 238459 I Language version available: English I Singapore - Monetary Authority of Singapore (MAS)

Distributor PB: Credit Suisse AG, Singapore Branch, 1 Raffles Link #03-01 One Raffles Link Singapore, 039393 Singapore I Language version available: English I Singapore - Monetary Authority of Singapore (MAS)