Yung-Shin Kung, Managing Director, is Head and CIO of CSAM QIS and one of the industry pioneers in the development and management of liquid alternative investment strategies. Since 2009, he has held various leadership positions in Credit Suisse’s Asset Management area including Head of Portfolio Management – Americas and Global Head of Hedge Fund Research within the Alternative Funds Solutions group. Mr. Kung was a Director at Merrill Lynch in the Financial Products Group from 2006-2009, where he developed and marketed customized structured products and provided advice and guidance to hedge fund investors. Prior to his time at Merrill Lynch, Mr. Kung spent eight years at Credit Suisse First Boston in several departments including structured debt capital markets, technology investment banking, and alternative investments. Mr. Kung began his career at Credit Suisse First Boston in 1997. He served on the Advisory Board of the Rutgers Big Data in San Francisco Certificate Program and is a member of the University of Chicago’s Leaders in Philanthropy. Mr. Kung holds a B.A. in Economics from the University of Chicago, where he was elected Phi Beta Kappa, and fulfilled the college's requirements for a B.A. in Statistics.

Global Risk Allocation Strategy

Systematizing Decades of Investment Wisdom

GRAS systematically encapsulates the investment insight of Jonathan Wilmot, who spent over thirty years with Credit Suisse, primarily as Chief Global Strategist.

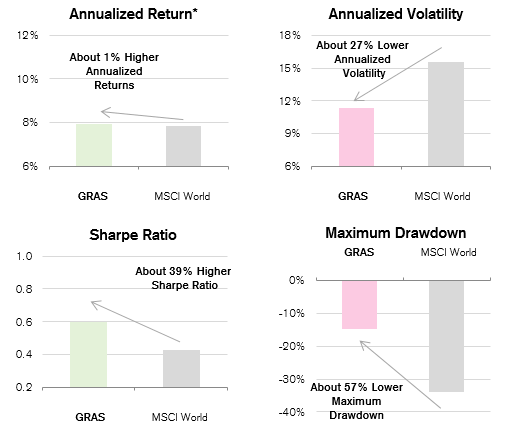

The program seeks, through active asset allocation, to provide targeted participation in equity market uptrends while potentially profiting during episodic market declines. We manage GRAS as a long-only and unlevered investment strategy, which offers a potentially meaningful reduction in the “left-tail” risk and path-dependency common to most equity market investments.

Source: Credit Suisse, Bloomberg. Data from October 10, 2014 to June 30, 2022.

*The hypothetical live performance of the simulated portfolio shown is for illustrative purposes only, it does not purport to represent an actual investment or that the actual performance of any investment would be similar to the hypothetical returns presented. These returns were not achieved by any actual investor and actual returns may vary significantly.

Historical performance indications and financial market scenarios are not reliable indicators of future performance.

The gains from GRAS versus common equity benchmarks are significant across a wide range of measures, including drawdown and negative skew.

Access

- Model Delivery

- Separately Managed Account

CSAM QIS Leadership