Yung-Shin Kung, Managing Director, is Head and CIO of CSAM QIS and one of the industry pioneers in the development and management of liquid alternative investment strategies. Since 2009, he has held various leadership positions in Credit Suisse’s Asset Management area including Head of Portfolio Management – Americas and Global Head of Hedge Fund Research within the Alternative Funds Solutions group. Mr. Kung was a Director at Merrill Lynch in the Financial Products Group from 2006-2009, where he developed and marketed customized structured products and provided advice and guidance to hedge fund investors. Prior to his time at Merrill Lynch, Mr. Kung spent eight years at Credit Suisse First Boston in several departments including structured debt capital markets, technology investment banking, and alternative investments. Mr. Kung began his career at Credit Suisse First Boston in 1997. He served on the Advisory Board of the Rutgers Big Data in San Francisco Certificate Program and is a member of the University of Chicago’s Leaders in Philanthropy. Mr. Kung holds a B.A. in Economics from the University of Chicago, where he was elected Phi Beta Kappa, and fulfilled the college's requirements for a B.A. in Statistics.

Managed Futures Strategy

An Investible Benchmark for Trend-Following

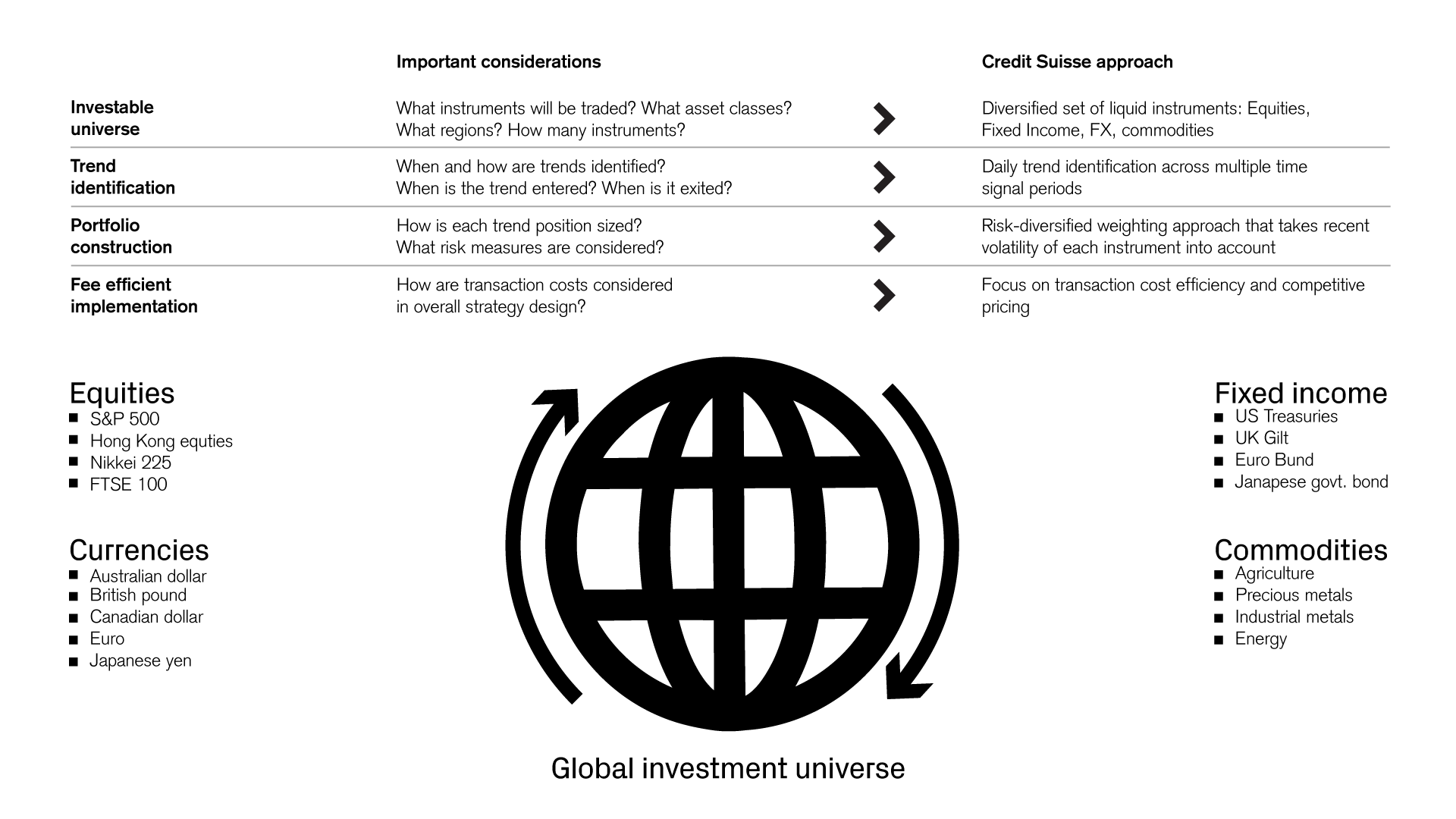

Our Managed Futures Strategy is an investible benchmark, tracked and employed by major institutional investors and their consultants. The program seeks to capture significant trends across major asset classes in a manner consistent with leading hedge fund benchmarks. Trend-following methodologies such as the Managed Futures Strategy have historically offered an important source of diversification, particularly during large equity drawdowns.

Introduction to the Managed Futures Strategy

QIS Global Head and CIO Yung-Shin Kung provides insights into this trend-following strategy that can potentially generate positive returns from both rising and falling markets.

Podcast: Deconstructing Alpha - What Are Managed Futures?

Stocks down, bonds down, managed futures up! What are managed futures, how do they work, and why are they performing so well in this “everything down” environment? To answer these questions, we go right to the source - Yung-Shin Kung, Head of Quantitative Strategies, & Portfolio Manager of the Credit Suisse Managed Futures fund. Tune in and listen up, this is something totally different!

MarketWatch article on the Managed Futures Strategy

Read MarketWatch article profiling the Credit Suisse Managed Futures Strategy Fund and how it has outperformed during a challenging environment.

How to Diversify with Trend Following

Yung-Shin Kung discusses the growing popularity of trend following strategies and addresses key factors investors should consider when allocating to the space.

By accessing the videos and/or podcasts in this page, you hereby consent to Credit Suisse disclosing your full IP address to YouTube and/or SoundCloud for the purpose of enabling you to view or listen to the content hosted in those platforms. These third party platforms are not operated or monitored by Credit Suisse, and your IP address and any other personal data collected, processed or stored by these third party platforms will be subject to their own privacy policies, and Credit Suisse will not be responsible for their treatment of personal data.

Credit Suisse Managed Futures Mutual Fund

Visit the US Mutual Fund webpage below to access fund information and materials.

Access

- US Mutual Fund

- UCITS Fund

- Model Delivery

- Separately Managed Account

Portfolio Team

Contact

The fund’s investment objectives, risks, charges and expenses (which should be considered carefully before investing), and more complete information about the fund, are provided in the Prospectus, which should be read carefully before investing. You may obtain copies by calling 800-577-2321. For up-to-date performance, please visit our website at www.credit-suisse.com/us/funds.

Note from Hedge Fund Journal on Awards Methodology: The Hedge Fund Journal data partner is Preqin. We do not invite submissions and we do not create or publish shortlists. We do follow Preqin categorisations but we also create additional categories; this work is done by our editor Hamlin Lovell based on his experience. The risk adjusted return calculations done to determine the best performers across the various award categories are largely done by Preqin but some are done by us. We contact the best performers – based solely on the data – and request their participation in the awards. If managers/funds decline to participate we scrap the category/award. We do not contact the next best performer to request their participation. Preqin provides The Hedge Fund Journal with performance data based on information available on our platform Preqin Pro, which offers performance data covering a universe of more than 30,000 funds. The performance data is compiled using public domain information and data reported to Preqin by the funds themselves. As Preqin is a provider of data, analysis, and insights rather than an auditor, the data we collect is not independently verified or assessed. Hence, Preqin cannot guarantee the validity of the information. The award was announced on May 17, 2023.

Risk Considerations: All investments involve some level of risk. Simply defined, risk is the possibility that you will lose money or not make money. Before you invest, please make sure you understand the risks that apply to the fund. As with any mutual fund, you could lose money over any period of time. Investments in the fund are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Principal risk factors for the fund include: The fund can invest in securities that may have a leveraging effect (such as derivatives and forward-settling securities) which may increase market 3 exposure, magnify investment risks, and cause losses to be realized more quickly. The fund may invest in commodity-linked investments, which may be more volatile and less liquid than the underlying instruments or measures. In addition, their value may be affected by the performance of the overall commodities markets as well as by weather, disease, and regulatory developments. The commodities industry can be significantly affected by commodity prices, world events, import controls, worldwide competition, government regulations, and economic conditions. The risk of loss in trading foreign currency can be substantial and may be magnified if trading on margin. Customers should therefore carefully consider whether such trading is suitable for them in light of their financial condition, risk tolerance and understanding of foreign markets. These risks include foreign currency risk and liquidation risk. Stock markets, especially foreign markets, are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks. Short positions pose a risk because they lose value as a security's price increases; therefore, the loss on a short sale is theoretically unlimited. May not be suitable for all investors. Additional risk information for this product may be found in the prospectus or other product materials, if available.

UBS Securities (USA) LLC, DISTRIBUTOR.

© UBS 2024. All rights reserved.