Gonzalo Borja, Head of Emerging Markets Fixed Income, Credit Suisse Asset Management

Over the past 20 years, emerging markets have come into their own and now offer investors a distinct, diverse, and mature asset class full of exciting and attractive investment prospects.

Emerging markets account for almost 60% of global GDP. Their economies continue to grow at a faster rate than their developed peers. Debt crises or currency shocks occur less frequently these days and are not as liable to spread via contagion as they once were. Today, countries classified as emerging – from Latin America, Europe, Asia, and elsewhere – boast robust institutions and stable markets.

Corporate bonds can offer an exciting and potentially lucrative way to gain access to these markets. The universe of emerging market debt (EMD) is highly diverse, not just across sectors and regions, but also in terms of issuer rating and company size. It features everything from quasi-sovereign commodity giants to manufacturing conglomerates or consumer companies – and presents a rich field from which to build well-constructed and diversified portfolios, including solutions concentrating on specific regions or ratings.

This edition of our fixed income video series explores the potential of emerging market corporate bonds. Watch and learn why this asset class is essential to a well-rounded fixed income portfolio.

We recognized the potential in this asset class early on. For this reason, as the asset class matured over the past decades, we did not need to play catch-up because we already had our capacities and capabilities in place – an advantage we have kept and intend to maintain.

Today, we can offer investors broad exposure to different emerging market corporate bond strategies with an emphasis on hard currencies. Covering global emerging markets as well as specific regions such as Latin America and Asia, the strategies have strong track records against both the benchmark and peer group. Our highly experienced, 15-person investment management team based in Zurich, Singapore, and Hong Kong pursues a disciplined investment approach that combines top-down and bottom-up analysis – looking at both the big economic picture and individual issuers – to deliver portfolios that are well diversified across regions, countries, and sectors.

Emerging Markets was the topic of the Credit Suisse Asset Management Quarterly Virtual conference which took place on June 24, 2021. Our experts looked closely at the relative advantages of active and passive approaches and talked about the unique role ESG plays in finding solid investment opport

Gonzalo Borja, Head of Emerging Markets Fixed Income, Credit Suisse Asset Management

Valerio Schmitz-Esser, Head of Index Solutions, Credit Suisse Asset Management

Dominik Scheck, Head of ESG, Credit Suisse Asset Management

The fund offers investors an attractive yield pickup compared to funds focusing on developed markets by investing in a well-diversified global portfolio of USD-denominated investment grade and high yield emerging market corporate bonds.

The fund aims to generate an above-average return through a well-diversified portfolio of USD-denominated investment grade corporate bonds from emerging market countries. It can also invest in developed market investment-grade-rated sovereign bonds and split-rated emerging market corporate bonds to increase diversification and capture interesting opportunities.

The fund offers investors a well-diversified portfolio of USD-denominated Asian debt instruments, bonds, notes, and similar fixed-interest or floating-rate securities from issuers domiciled in Asia or conducting their main business activities in Asia.

The fund offers investors exposure to one of the best established and most mature bond markets among emerging economies, additionally characterized by a high diversity of countries, sectors, and ratings. It invests predominantly in USD-denominated Latin American corporate and quasi-sovereign bonds, including investment grade and noninvestment grade.

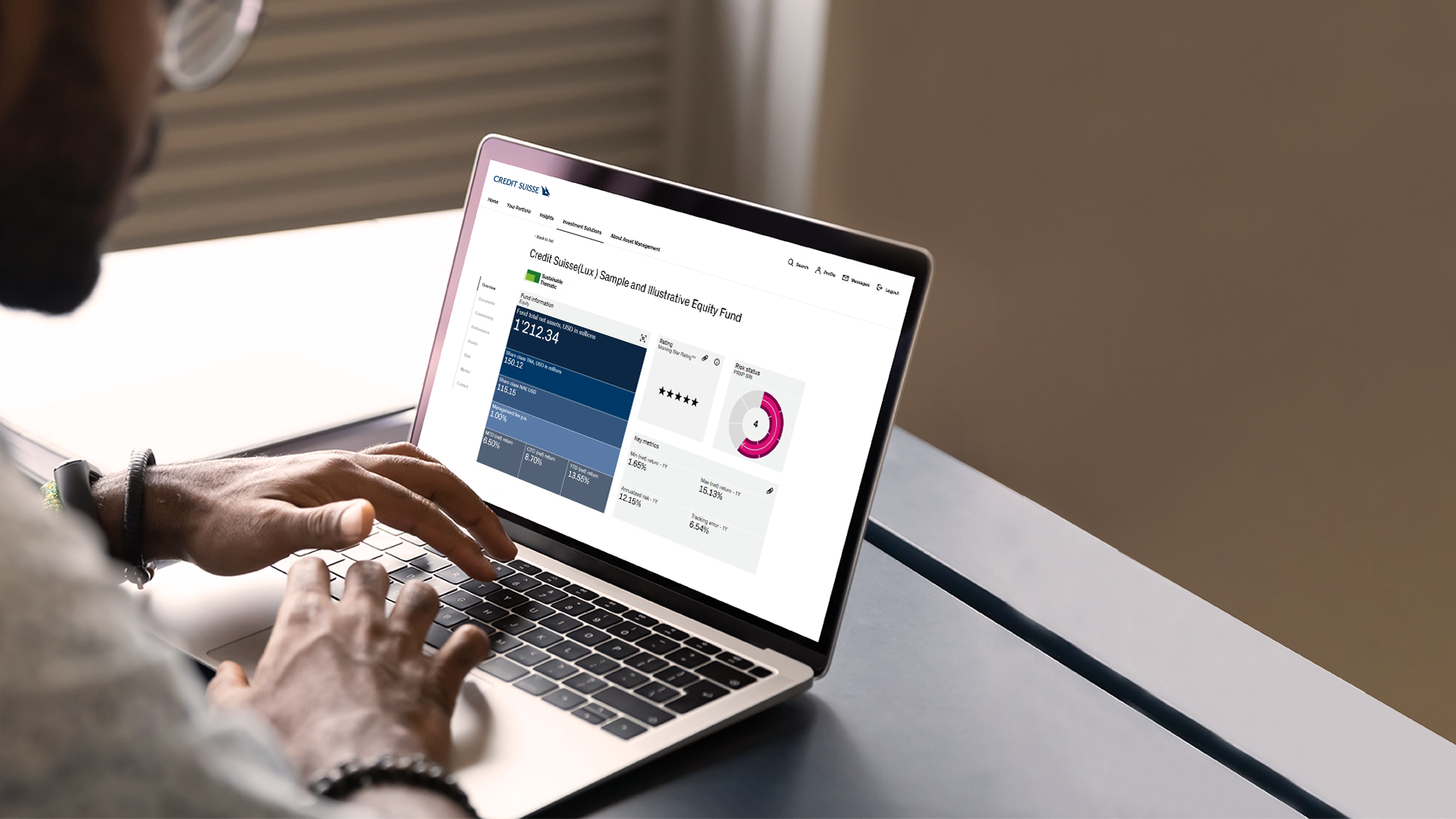

Find investment products that suit your personal needs. Choose from our extensive range of investment solutions across all major asset classes, and access all product-related information.

Contact us to learn about exciting investment opportunities. We are here to help you achieve your investment goals.